(Image from here.)

I’m irritated about gas prices (and all the knock-on effects) but probably not for the reasons you might think.

I’m irritated because it should have happened decades ago.

Let me explain.

Oil is a finite resource. (Less so coal, but I’ll address that in a different post.) There is always a calculus between oil demand, oil availability, and oil processing cost. This involves the cost to extract the oil, transport the product, and turn it into usable material. These are referred to as upstream, midstream, and downstream processes. Midstream processes are essentially the same regardless of source, so we’re going to neglect that until later in this discussion. Downstream process cost reflects the quality and cost of the oil produced, so we’ll leave that for later, too.

Demand is (or can be) elastic. The amount available is only elastic with respect to the cost to capture the oil. I.e., there’s a lot of oil in the ground with differing costs to capture it. As long as the demand can support the cost, there is oil available. (Within limits. More on that in a moment.)

Which brings us to upstream processing: the cost of extraction.

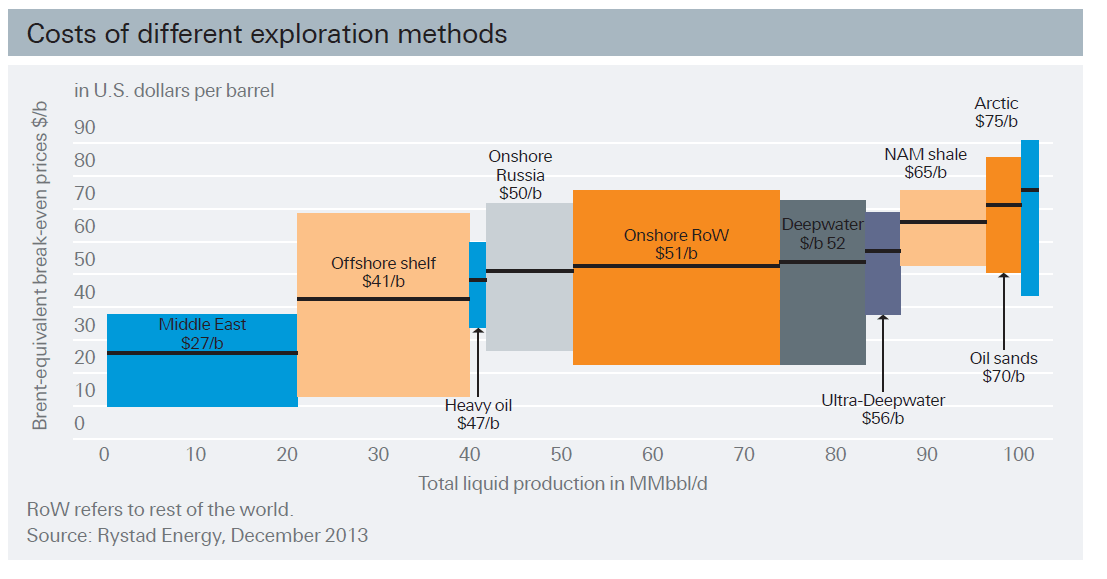

There are many different methods of extraction. (See here.) It should come as no surprise that each method comes with a price tag. Middle East oil—accessible from land, not too deep, not too viscous, not too much sulfur—is the cheapest. Costs increase with difficulty: off-shore shelf, onshore Russia, etc. The most expensive is extracting from shale deposits, oil sands, and the Arctic. Arctic oil is the worst but given global warming, that might change.

Costs come from technical challenges, exploratory expenses, and regulatory obstacles.

Thus, when oil was getting a lot of money/barrel, shale and oil sands were profitable resulting in fracking in the Dakotas and elsewhere. When the price of oil falls, those methods are no longer profitable and cease operation.

Note: these costs neglect the actual cost of oil production which would include the cost of pollution, habitat destruction, cultural annihilation, global warming, etc. Were that included, none of these efforts would be profitable. This is important to remember. It means the price at the pump in no way reflects the true cost of the product.

Remember I said oil is a finite resource? The costs of extraction reflect extraction difficulty. Profit-driven corporations look for cheap methods like a heat-seeking missile: cheap oil is the preferred target. Which means it will be used up first. As that resource dries up and becomes scarce, its price goes up and other sources become more attractive.

This goes on until the point of peak oil: the point where the economically viable extraction of oil must begin to decrease. As the price increases, the total amount must at that point begin to decrease. Eventually, oil wouldn't be worthwhile to extract.

People have been predicting peak oil since the mid-twentieth century. The date has been put off as technology improves. Remember, this is not oil depletion. There would still be oil in the ground. Peak oil is the beginning of the downhill slope towards where there just wouldn’t be sufficient money to pull it out, regardless of demand.

Peak oil is coming. We only have control over when and how we meet it. Some have estimated peak oil sometime in the next 10 to 15 years.

There’s a knock-on effect with the increase in the price of extraction. It drives up the costs of the midstream and downstream operations. Downstream operations (i.e., refineries) take significant energy to operate, much of it in the form of petroleum. Refineries use fractional distillation to separate components. This takes heat. The heat is supplied in the form of burning petroleum products. In addition, as we move away from the nice, pure crude we like to uglier, nastier materials, it takes more energy to refine them, upping the costs yet again. Thus, the increase in the cost of extraction drives up refinery costs. Midstream operations are largely transportation. Which—you guessed it—uses petroleum products.

People have this expectation that these cost problems will somehow be gradual. After all, we use these products at a more or less constant rate. We should see a gradual increase as the problems begin to crowd in.

But that’s not how these sorts of systems work—neither the economic system we’re discussing today or the thermal climate system it’s destroying. Instead, there are times of gradual movement punctured by an event causing sudden changes, followed again by a period of gradual movement. We can see this in gas price changes: periods of sudden increase responding to some event (war in Ukraine, I’m looking at you.) followed by a reduction in price to a point above the original. The price will not return to the original because of the increase in extraction costs. Its reduction is not certain. The price may remain very high.

BTW: this reminds me of Gould and Eldredge’s idea of punctuated equilibrium in evolution. Periods of stasis where the environment remains within narrow limits, followed by rapid responses to sudden environmental changes.

Thus, the costs we’re seeing now are inevitable and reflect a known progression in the underlying economics of the oil industry. It’s the cost’s stepwise nature that seems to surprise us.

But we could have avoided all this.

What we should have done is tack on a gas tax decades ago—a big one, of 100% or better—phased in slowly so we could get used to it and create adaptive mechanisms. Then, use that money not just for roads and bridges but for research to get us off fossil fuels, funding fuel alternatives, and public transportation. We just don’t need to drive as much as we do. If the pandemic has taught us anything, it has taught us that. It would have by no means been enough but it would have given us a disincentive to use cars and provide a funding mechanism.

And, yes, there would have been all sorts of issues in managing that money to prevent fraud and abuse. It is the nature of money that some will figure out how to game the system at the expense of others. We don’t seem to mind it when the defense and finance industries scam us but we get all pissed off when it happens in systems that are intended for our benefit. Then, we get all huffy and say, well, it won’t work, and scrap it. It’s an American character flaw.

This is why I’m irritated. Now, we have the same cost we should have had a long time ago, without any time to adapt or build mechanisms to protect us, and we’re getting nothing for it. Instead, we’re desperately paying like addicts when the dealer has upped the price.

I don’t have any sympathy for his increased costs, either.

No comments:

Post a Comment